Online Security Protection

Ensuring the security of your personal information online is a top priority for us.

Secure Online Banking Sign In

When you sign in to our Online Banking, your Access ID and Password are secure. The moment you click Enter and before your Access ID and Password leave your computer, encryption using Secure Sockets Layer (SSL) technology ensures the privacy of communication between you (your browser) and our servers.

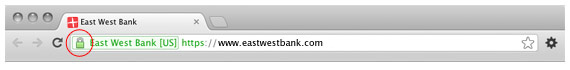

Browser Security Indicators

You may notice when you are on our homepage that some familiar indicators do not appear in your browser to confirm the entire page is secure. Those indicators include the small "lock" icon in the top left corner of the browser frame and the "s" in the Web address bar (for example, "https").

To provide the fastest access to our homepage for all of our millions of customers and other visitors, we have made signing in to the Online Banking area secure without making the entire page secure. Please be assured that your Access ID and Password are secure and only our East West Bank servers have access to them.

Consumer Security

We are committed to protecting your online security. We offer these tips and best practices from Digital Defense on how to safeguard your accounts and privacy.

Business Security

Protect Your Business from Email Phishing

"Email phishing" is a scheme where a fraudster intercepts payment instructions from a legitimate vendor to a business customer, changes the payment beneficiary information, and instructs the unsuspected business customer to make payment to the fraudster's account instead of the vendor's account. The fraudster ends up with the payment while the legitimate vendor does not get paid.

We highly recommend that you implement the following best practices to protect your company from becoming a victim of this scheme:

These are proven and longstanding fraud management and operating controls that are widely used by companies, including East West Bank. In addition to the callback procedure above, we also recommend that you continue to use the additional recommendations below to protect your company:

Protect Your Business from Other Threats

Security And Protection

Fraud Prevention

Tips on how you can protect your information and identity, and what to do if you are a victim of fraud.

Privacy

Read our privacy policies and learn how to keep your information private.

Other Resources

Inform Us Immediately!

If you believe your information has been compromised and/or you have been a victim of fraud, it is important that you contact us immediately:

For consumer customers:

Customer Service Center

888-895-5650

Mon - Fri, 6:00 am to 7:00 pm PT

Sat, 9:00 am to 5:00 pm PT

For business customers:

Commercial Banking Customer Service

888-761-3967

Mon - Fri, 6:00 am to 7:00 pm PT

Report Fraud

Email Us