Insights

How WeChat Pay and Alipay Can Strategically Grow Your Business

By Melody Yuan

How integrating WeChat Pay and Alipay can help your business stand out and gain new customers.

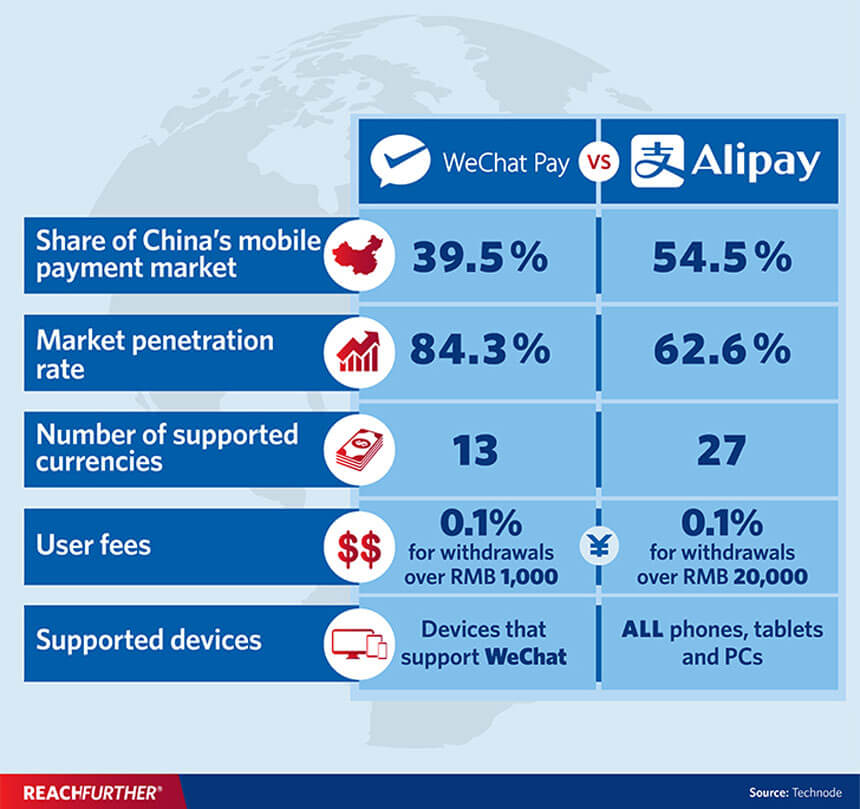

China has been moving rapidly toward a cashless society as the government pushes for the adoption of a digital yuan. It comes as no surprise then that the country’s digital payment systems and mobile wallets are among some of the most sophisticated and integrated systems in the world. Of the various payment systems, WeChat Pay and Alipay together comprise 94% of the market share in China.

According to research by Daxue Consulting, mobile phone payments have become the norm among many Chinese consumers, with more than 776 million people using a form of mobile payment in China as of March 2020. Of course, the COVID-19 pandemic boosted the trend for mobile, online and QR payment systems, but China was already well on its way to becoming a cashless society.

E-commerce transactions in the U.S. grew by 44% in 2020, with many targeting Chinese consumers both in and out of the U.S. For businesses outside of China that may be looking to tap into its more than 1.4 billion potential consumers, having WeChat Pay and Alipay integrated could provide a crucial competitive edge.

“WeChat Pay and Alipay serve as a way for businesses to cater to Chinese tourism and also local shoppers that have accounts in China that they want to use in the U.S.,” says Dustin Sullivan, vice president and national merchant sales manager at East West Bank. “It’s a way that the client can pay in their home currency with the local business having the deposit done in U.S. currency.”

With more than 92% of people in China’s largest cities reporting that they use WeChat Pay or Alipay as their main method of payment, having this system integrated into your business and catering to that demographic’s comfort and convenience will gain their trust and potentially transform them into repeat customers.

WeChat Pay and Alipay—what’s the difference?

While Alipay has been around for longer, both payment systems are used widely and frequently among Chinese consumers. Alipay is a payment system owned by the e-commerce giant Alibaba and officially debuted in China’s mobile payment market back in 2008. Because mobile payment systems were still a new concept then, Alipay had a large portion of the market share.

WeChat Pay came about in 2013, and its main difference to Alipay is that it functions as an additional feature within WeChat, China’s biggest social media and instant messaging app. What this means is that users don’t even have to leave the app when switching from chatting with friends and posting on their timelines, to shopping online or booking appointments. Everything can be done inside WeChat.

“WeChat Pay and Alipay are favorite payment options for tourists and students from China, and while the number of visitors from these two groups have dropped drastically during the pandemic, we can expect this number to rise again,” says Daniel Park, assistant vice president of GTS merchant services at East West Bank. “According to Citcon, demand and processing volumes already grew last year due to a high number of online businesses accepting payments through WeChat Pay and Alipay. I was also told that continuous growth can be expected in 2021 as the economy slowly gets back to normal.”

How to integrate WeChat Pay and Alipay for your business

“The process is very easy,” says Sullivan. “The customer sets up the account much like a merchant services account, and then they get a scanner to use on their mobile wallet QR code that is standard with these methods of payments. Once scanned, the money is pulled from the Chinese bank account linked to Alipay or WeChat Pay and goes through a currency conversion into U.S. dollars, and then it’s deposited into the business’ U.S. bank account.”

This level of convenience is just what Chinese consumers are looking for.

“TS Emporium is one of our top clients for use of Alipay and WeChat Pay,” says Sullivan. “They’ve used it for the last three years and do many transactions a month with the ability of this integrated software.” TS Emporium is the largest purveyor of American ginseng, traditional Chinese medicine and other food items in the U.S., and uses the WeChat Pay and Alipay functionality daily.

WeChat Pay and Alipay also offer easy-to-use online invoicing. “U.S. businesses can easily generate QR codes to email/text with invoices, and then the consumers can simply scan the QR codes with their phones to pay the invoices,” Park explains. However, regulations prohibit people from using WeChat Pay and Alipay for certain investment-type transactions, such as buying real estate and insurance-related products, Park says.

Your business may not have existing relationships with Chinese businesses or consumers today, but that may change with the added capability of Chinese payment systems. There is mounting confidence that Chinese tourists and businesses will bounce back in the U.S., and now may be the time to prepare your business for their arrival. China Outbound Tourism Research Institute is forecasting 100 million international trips by mainland Chinese in 2021, as the country bounces back from the pandemic. While much of this is contingent upon perceptions of overseas safety, convenience and flight availability, Chinese consumers, like much of the world, are ready to travel again.