College planning

Plan Ahead for College

Don’t know where to start with college savings? Let us show you how to get started with a 529 savings plan.

A 529 savings plan is one of the most popular ways of investing for a college education. This plan allows your investments to grow free from federal income taxes, and there are no federal taxes when distributions from the plan are used for qualified higher education expenses, such as tuition, room and board, books, and more.

This is a hypothetical example. The tax rate applied in the above chart is a blended federal and state tax rate of 24.45%. This example does not represent the performance of any particular investment. Income may be subject to federal alternative tax.

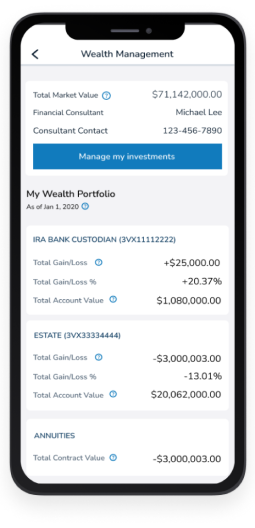

Personalized investment services for you and your family.

Get an investment and wealth management plan customized just for you.

Achieve your goals with a range of tax-advantaged financial products.

Get a head start on college savings with the right financial plan.

Prepare for life’s events and stay on course financially with the right plan.

Formulate strategies that meet your business needs.

Receive the support you need through the estate-planning process.

1 To access your investment portfolio using our Mobile App, you must be enrolled in the Bank’s mobile or online banking service. Additional terms and conditions may apply. East West Bank does not charge for Mobile Banking. However, your mobile service provider may charge for sending and receiving text messages on your phone. Check with your service provider for details on specific fees and data charges that may apply.