Estate Planning

Preserve Your Legacy

Keep what you’ve built for the next generation to enjoy. Trust our experience to guide and support you through the estate-planning process.

Proper estate planning helps eliminate uncertainties over the administration of a probate and maximize the estate value by reducing taxes and expenses.

Estate planning* involves the will, trusts, beneficiary designations, powers of appointment, property ownership (joint tenancy with rights of survivorship, tenancy in common, tenancy by the entirety), gifts, and powers of attorney.

*Consult your legal or tax counsel for advice concerning your personal circumstances. Neither East West Bank, Cetera Investment Services, nor any of its representatives may give legal or tax advice.

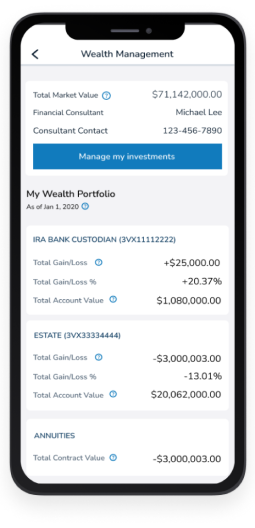

Personalized investment services for you and your family.

Get an investment and wealth management plan customized just for you.

Achieve your goals with a range of tax-advantaged financial products.

Get a head start on college savings with the right financial plan.

Prepare for life’s events and stay on course financially with the right plan.

Formulate strategies that meet your business needs.

Receive the support you need through the estate-planning process.

1 To access your investment portfolio using our Mobile App, you must be enrolled in the Bank’s mobile or online banking service. Additional terms and conditions may apply. East West Bank does not charge for Mobile Banking. However, your mobile service provider may charge for sending and receiving text messages on your phone. Check with your service provider for details on specific fees and data charges that may apply.