Our Community

Serving Our Communities

We focus on the most pressing needs to make the biggest impact: quality of life, small business growth, financial literacy, and empowering the underserved.

The need for affordable housing has a lasting impact on our families within our community. We’re committed to supporting proven programs and partners that reduce homelessness, preserve affordable housing and increase homeownership.

We identify and support partners that make a difference. In addition to funding down payment matching programs like the Federal Home Loan Bank’s WISH First-Time Homebuyer program, our associates participate in annual home builds with Habitat for Humanity. We also work with Affordable Housing Clearinghouse to provide vulnerable households with foreclosure prevention and financial counseling services.

Since 1996, we’ve partnered with the United Way of Greater Los Angeles on their mission to create “Pathways out of Poverty.” We’re proud to participate in events like WalkUnitedLA (formerly HomeWalk), an annual event to end homelessness in LA County, and will continue to support their efforts to increase high school graduation rates and ensure financial stability.

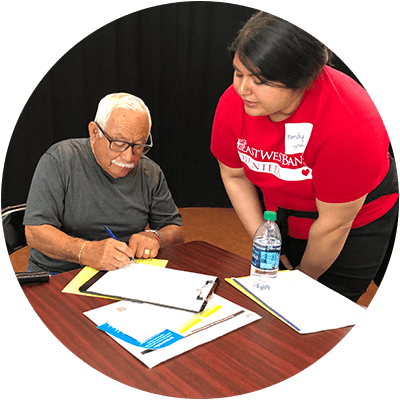

We run homeownership workshops throughout our communities to provide mortgage education to low- and moderate-income individuals. Geared to the needs of first-time homebuyers, our workshops cover everything from the application and loan qualification process to selecting a loan with fair and affordable terms for sustained homeownership.

We provide free tax preparation services to low-income families and individuals through organizations like Mission Economic Development Agency (MEDA), BakerRipley and the Chinese Newcomers Service Center. The IRS Volunteer Income Tax Assistance (VITA) program ensures families receive the maximum possible tax return.

If you’d like to submit a donation or sponsorship proposal for consideration, email us.