U.S.-Asia Business

3 Predictions for the U.S. Economy in 2023

By Rayliant

The US labor, housing and stock markets may see further slowdown in 2023. But if so, that’s not necessarily a bad thing! As these markets cool off and revert to healthy norms, not only will the Fed find itself comfortable taking its foot off the brakes, but investors will find themselves in a position to enjoy more sustainable growth and at better valuations than they’ve seen in years. On that note, here are three predictions for the year ahead.

Prediction 1: US labor market strength will finally moderate.

The US labor market boomed in 2022 despite restrictive monetary policy and widespread economic fears. The Fed has made it clear that until the job market softens, it won’t likely give up its fight against inflation. Entering 2023, how much longer can growth in employment and wages persist?

Tech layoffs aren’t enough to cool a red-hot job market.

Reading the financial news, it might seem like the tide has turned. Last quarter saw high-profile layoffs at companies like Meta, Amazon, and Twitter. While these cuts grabbed headlines, they were largely among skilled workers who are highly employable. In fact, a recent survey by ZipRecruiter found that nearly 80% of those laid off in tech found a new job within 90 days. Fed tightening also failed to impact less glamorous industries where middle-income workers are still in high demand.

Leading job market indicators remain relatively strong.

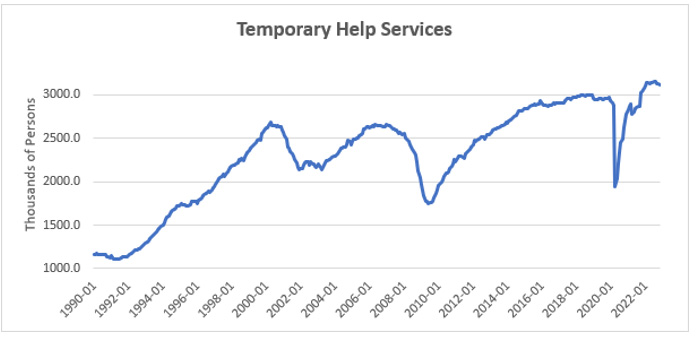

During past economic downturns, employers cut temporary workers before reducing permanent staff. As a result, a drawdown in temporary jobs is a canary in the coalmine for the broader labor market. This and other leading indicators are an important tool to predict future labor market trends.

For example, data from BLS (see below) show that temporary jobs peaked in 2022; but they still remain historically high. While we do expect Fed policy to finally hit the labor market in 2023, that isn’t likely to happen until leading indicators like temp hiring show a more significant decline.

Prediction 2: The US housing market will not crash; it will normalize.

The typical American has over 70% of their net worth in their home, and many are afraid of a so-called “housing bubble” reminiscent of the one that peaked in 2006. While it’s true that home prices may decline in 2023, we expect that decline to be relatively modest.

There is still a home shortage in the United States.

Some experts worry about a housing market crash because mortgage rates have breached 7%. But the fact remains that inventory still falls well short of demand. In part, that’s because homebuilders have been reluctant to ramp up construction given a slowdown in buying.

According to the National Association of Realtors (NAR), US home sales declined -7.7% in November and are now roughly 37% off their recent peak in January 2022. Even with fewer sellers bringing new listings, that slowdown means houses are sitting on the market for much longer, leading to an increase in supply, which is now expected to rise by nearly 23% in 2023.

If you’re a buyer, take comfort in these figures; they will help normalize the property market somewhat. They mean the pandemic-era real estate boom is probably over.

Property prices are well-supported.

If you’re a seller or property investor, these numbers are also not terrible news. A mortgage rate “lock-in effect” and the shortage of supply just mentioned will combine to prevent 2023-2024 from becoming too painful for homeowners. While some real estate investors are still fearful that property prices will decline further and faster, many of these investors are anchored to traumatic memories of the ’08 crisis. The data doesn’t support this analogy.

It took over five years for the housing market to go from peak to trough in the last cycle. Even then, the steepest housing price decline over a 12-month period during the Global Financial Crisis (GFC) was -12.7%. In the current cycle, home prices peaked in June 2022 amidst foreclosure and default rates at their lowest level in decades. Without extreme distress like during the GFC, there is little reason to fear a widespread crash.

Mortgage rates are starting to fall.

A high mortgage rate, coupled with high home prices, have crushed affordability this year. Monthly payments of the typical borrower rose by more than 50% in 2022. However, US mortgage rates began falling in December, and we predict they will continue their decline in 2023.

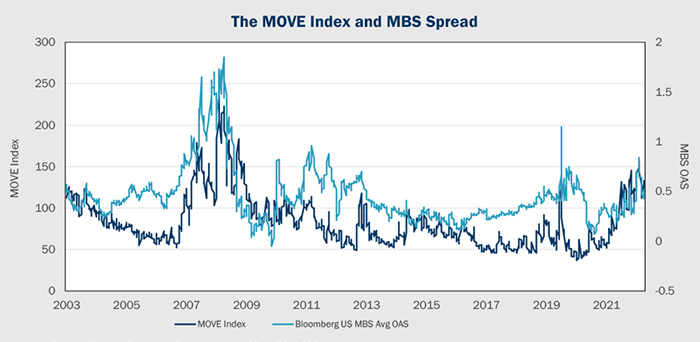

The mortgage spread—which can be measured as the gap between the 30-year fixed mortgage rate and the government borrowing rate—is much higher today than it has been in the past. The driving factor is market uncertainty about the effects of Fed policy, which has resulted in outsized fluctuation in interest rates. Indeed, if we visualize the relationship between the MOVE index—a volatility index, like the VIX for bonds—and the observed mortgage spread, we note that MBS spreads tend to widen when the MOVE index spikes.

Looking ahead, the mortgage market is already pricing in further rounds of rate hikes amidst moderating inflation. As uncertainty declines from current highs, the corresponding risk in mortgage spreads should dissipate, bringing mortgage rates down and marginally improving affordability.

Prediction 3: The equity bear market continues—but buying opportunities will finally emerge.

Of course, the question on every investor’s mind seems to be: When will the bear market in US stocks that began in 2022 finally give way to a new bull rally? This question might be the most oft-asked because it’s also one of the hardest to answer. While we don’t claim to have a crystal ball revealing the precise bottom of the market, we are inclined to believe stocks haven’t reached it yet.

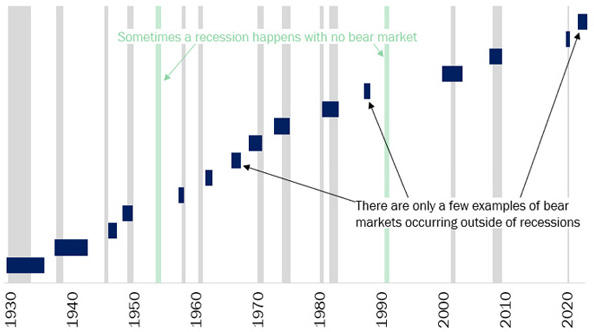

History may not repeat, but it often rhymes. As the chart below shows, no bear market associated with a recession—and most are—has ever ended before its recession even began. This suggests stocks won’t see their lows before the economy officially enters a period of contraction. As mentioned before, the Fed is doing its part to hasten that outcome, even if some members are holding on to hopes of a soft landing.

Bear markets usually accompany recessions, don't end until they've begun.

U.S. Bear Markets, 1929 - 2022

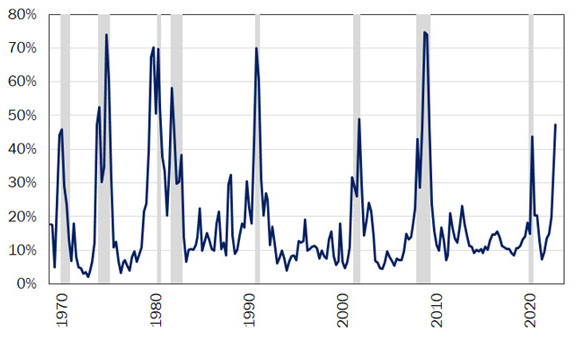

Indeed, there are signs that we might reach this milestone soon. Each quarter, the Philadelphia Fed’s ‘Anxious Index’ surveys pro forecasters on their estimate of the probability that next quarter will bring contraction for the US economy. In nearly five decades since the bank began tracking economists’ predictions, seeing this measure climb past 40% has never thrown a false alarm—and we just crossed that threshold in the Fed’s November reading (see below).

Philadelphia Fed's 'Anxious Index' suggests economists feeling downbeat.

Professional forecasters' probability of recession in the following quarter, 1968 Q4 - 2022 Q4

As most equity investors know, one of the most common measures of a company’s value is its price-to-earnings (P/E) ratio. In 2022, we saw prices drop precipitously; in 2023, we expect earnings to follow. In a recession—especially one that follows a speculative bubble economy with mass over-investment—the decline in earnings can be precipitous. This means prices must fall more before P/E contracts to its historical average. Once earnings begin to decline significantly, it will signal the beginning of the end. Yes, this will be the most difficult period for equities markets; but it will also be the moment some of the best tactical buying opportunities emerge.