Why am I unable to deposit my check through the App?

If you’re experiencing difficulties depositing your check using our mobile check deposit service, consider the following tips:

Check condition:

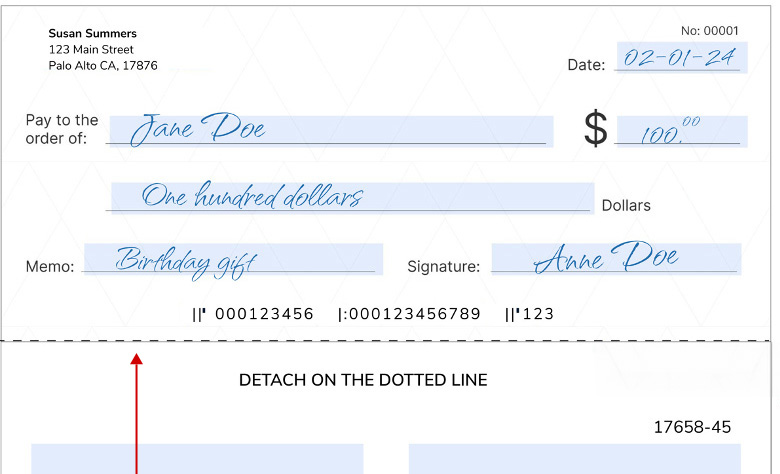

Carefully detach the check from your check book or any attached stub to ensure a clean check edge (i.e., no portion of the stub attached, etc.) and to avoid any damage to the check. Review the check to ensure that it is in good condition (e.g., no rips or tears, information is legible, etc.). Checks that are torn or defaced will not be accepted.

Ensure the check is in good condition (e.g. no rips or tears, information is legible, etc.)

Detach stubs carefully & entirely.

- Proper endorsement:

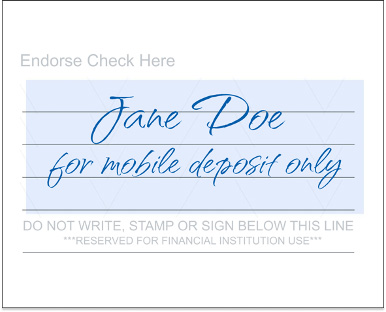

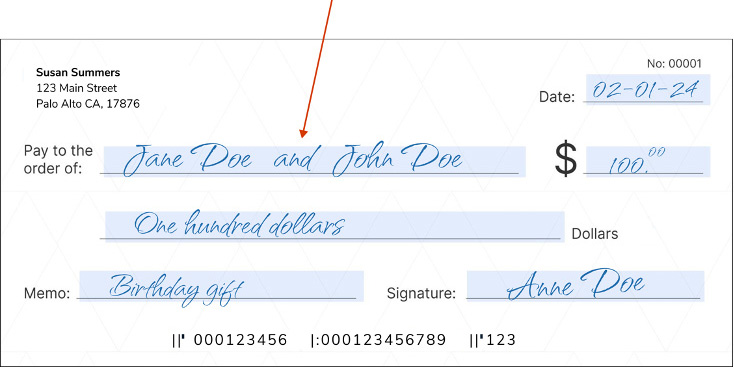

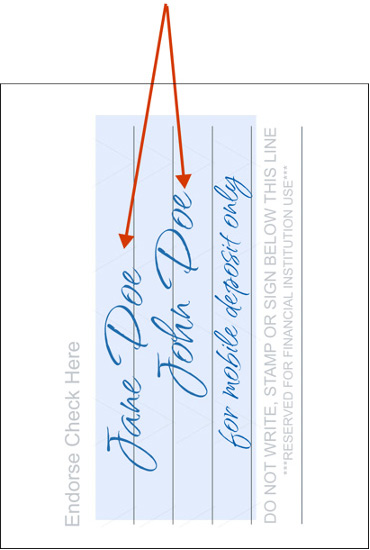

Be sure to sign (endorse) the check on the back in the designated area and write "For Mobile Deposit Only" under your signature. If the check is payable to joint account holders as “and” payees (e.g., Jane Doe and John Doe), both signatures are required.

If check is payable to joint account holders as “and” payees (e.g., Jane Doe and John Doe), both signatures are required.

Both signatures are required.

Optimal scanning conditions:

Place the check on a plain, dark background in a well-lit area, ensuring that the edges fit within the “box” displayed in the image capture window. If the check has been previously folded, flatten the check before taking your photo.

Physical checks only:

Always take a photo of the physical (original) check. Capturing an image of a “check photo” will result in submission failure.

Check date:

Ensure the check is not future dated (post-dated).

Ineligible items:

The following items are not eligible for mobile check deposit:Checks payable to any person or entity other than you and/or a joint owner on the account.

Checks with evidence of alternation or suspected fraud.

International checks (not drawn on a U.S. financial institution).

U.S. Savings Bonds, U.S. Postal Service Money Orders, remotely created checks, and cash.

What should I do after completing a mobile check deposit?

After submitting your mobile check deposit request, retain the original check in a secure area for 14 days before you securely destroy it.

Although it does not happen often, resubmission of the check image may be required if issues arise during processing. In the event your mobile check deposit is unable to be processed, we’ll send you an email specifying the reason.

When will my funds be available after a successful mobile check deposit?

Mobile check deposits you make on a business day before the cutoff time will generally be available no later than the 3rd business day after the day of your deposit, however, the first $225 will be available the 1st business day after the day of deposit.

In some cases, a longer delay may apply, such as when your Mobile Deposits total more than $5,525 on any one day, in which case the amount over $5,525 will generally be available no later than the 7th business day after the day of deposit.

To learn more about funds availability and the conditions that may delay availability, please refer to the “Holds for Uncollected Funds/Delayed Funds Availability” section of the Bank’s Deposit Agreement.

When will my funds be available after a successful mobile check deposit?

Mobile check deposits you make on a business day before the cutoff time will generally be available no later than the 3rd business day after the day of your deposit, however, the first $225 will be available the 1st business day after the day of deposit.

In some cases, a longer delay may apply, such as when your Mobile Deposits total more than $5,525 on any one day, in which case the amount over $5,525 will generally be available no later than the 7th business day after the day of deposit.

To learn more about funds availability and the conditions that may delay availability, please refer to the “Holds for Uncollected Funds/Delayed Funds Availability” section of the Bank’s Deposit Agreement.